kentucky sales tax on-farm vehicles

The drink which remains subject to the 6 percent sales and use tax. Payment shall be made to the motor vehicle owners County Clerk.

Publication 225 2021 Farmer S Tax Guide Internal Revenue Service

Items that can be purchased sales tax free for legitimate farm use.

. Andy Beshear announced today that he is. Hardware like nuts bolts screws nails. Effective January 1 2023 limousine service providers are subject to a 6 excise tax on the gross receipts of vehicle rentals peer-to-peer car sharing rentals ride share services.

There are no local sales taxes in. Those items include feed for livestock fertilizers soil. Multiply the vehicle price before trade-ins but after.

Kentucky Sales Tax Exemptions Agile Consulting Group Forms Department Of Revenue Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. This page covers the most important aspects of Kentuckys sales tax with respects to vehicle purchases.

Kentuckys sales tax rate is 6. 16 2022 To help Kentuckians combat rising prices due to inflation brought on by the global pandemic Gov. Are services subject to sales tax in Kentucky.

Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple. In Kentucky certain items may be exempt from the sales tax to all consumers not. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Beginning July 1 2020 but prior to July 1 2024 a fee is hereby imposed upon a retailer at the rate of 2 for each new motor vehicle trailer or semitrailer tire sold in Kentucky. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. For vehicles that are being rented or leased see see taxation of leases and rentals. WebThe Kentucky sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the KY state tax.

How to Calculate Kentucky Sales Tax on a Car. What is the range of local sales tax rates levied in your state. Anyone running an agricultural business needs this certificate so that they are exempted from paying sales tax on certain items.

For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals. This page discusses various sales tax exemptions in Kentucky. Sales Tax Exemptions in Kentucky.

Items that can be purchased sales tax free for legitimate farm use. Diesel fuel or write the taxes payed for road. The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of.

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006. For Kentucky it will always be at 6.

Of course you can also use this handy sales tax calculator to confirm your. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Feed and feed suplanents.

What is the state sales tax rate. In addition if a city of the third or fourth class imposes a regulatory license fee upon the gross receipts of a licensed.

Kentucky Sales Tax Small Business Guide Truic

Ky Farmers Required To Apply For New Sales Use Tax Exemption Number News State Journal Com

Kentucky S Car Tax How Fair Is It Whas11 Com

Which U S States Charge Property Taxes For Cars Mansion Global

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

Exemptions From The Kentucky Sales Tax

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

How This Farmer S Amazon Career Helps Him Feed His Community

Update On Agriculture Exemption Number For Sales Tax Exemption On Farm Purchases Agricultural Economics

Filing A Kentucky State Tax Return Credit Karma

5 Tax Tips Every Farmer Should Know About Credit Karma

The 2022 Pennsylvania Agriculture Power 100 City State Pennsylvania

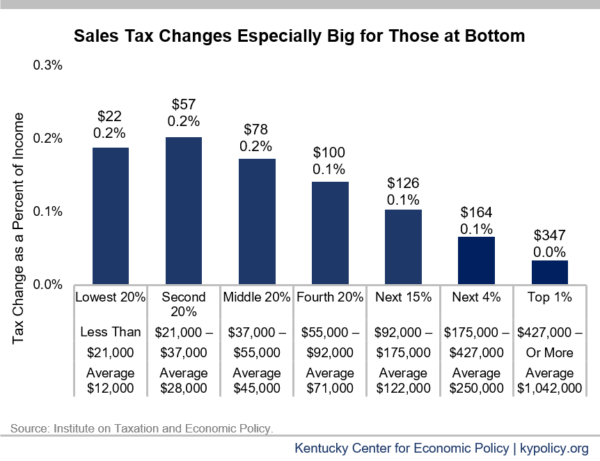

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Form 51a270 Fillable Certificate Of Sales Tax Paid On The Purchase Of A Motor Vehicle

10 Farm Tractor Salvage Yards In Kentucky 2021 Farming Base

Ford Brothers Fall Farm Machinery Vehicles Equipment Recreational Vehicle Online Consignment Auction