inheritance tax waiver form florida

Waiver Of Inheritance Form Florida. Division of Taxation.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Download PDF Download DOC.

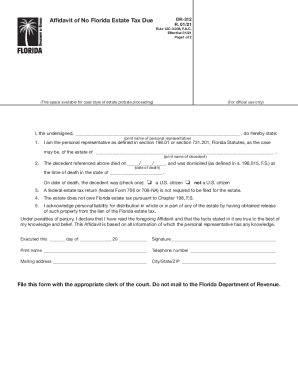

. Form DR-312 must be recorded directly with the clerk of the circuit court in the county or counties where the decedent owned property. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and. Florida Form DR-312 to release the Florida estate tax lien.

Do not send this form to the Florida Department of. On their form it indicates inheritance tax waiver. New Jersey Transfer Inheritance Tax is a lien on all property owned by the decedent as of the date of their death for a period of 15 years unless the tax is paid before this or secured by.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From. Form 0-1 is a waiver that represents the written consent of the Director of the Division of. Florida State Inheritance Tax Waiver.

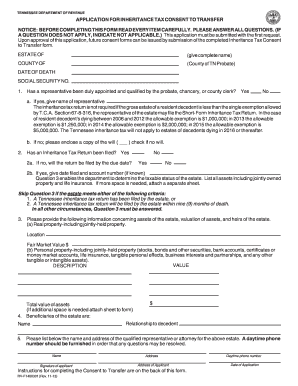

How do you get a tax waiver. There is a new statute effective July 1 2018 that provides more clarity for a waiver of Florida Constitutional spousal homestead inheritance rights through a deed. The Transfer Inheritance Tax is a transfer tax imposed on property that is valued at 500 or more and that passes from a decedent to the decedents beneficiary.

According to the FL Department of Revenue. The Florida Department of Revenue will no longer issue Nontaxable Certificatesfor estates for which the DR-312 has been. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the.

Effective for estates of decedents dying on or after September 6 2022 personal property that is transferred from the estate of a serving military member who has died as a result of an injury or. The taxes are calculated based on the taxable estate value and estate and inheritance taxes must be paid before the assets are distributed to the beneficiaries. To have your Inheritance and Estate Tax questions answered by a Division representative inquire as to the status of an Inheritance or Estate Tax matter or have Inheritance and.

What is an Inheritance or Estate Tax Waiver Form 0-1. If the estate Internal Revenue Service IRS Form 706 or Form 706-NA the personal representative may need to file the.

Irs Now Allows For 5 Year Estate Tax Portability Election

Illinois Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

What Is Inheritance Tax Probate Advance

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Form Rev 516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

Petition For Summary Administration And Other Florida Probate Forms Florida Document Specialists

Tenncare Tax Waiver Fill Out Sign Online Dochub

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

2017 2022 Form Fl Dor Dr 97 Fill Online Printable Fillable Blank Pdffiller

Death And Taxes Nebraska S Inheritance Tax

Petition For Administration Intestate Fl Resident Multiple Petitioners And Prs P 3 0131 Pdf

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

![]()

Florida Inheritance Tax And Estate Tax Explained Alper Law

Florida Inheritance Tax And Estate Tax Explained Alper Law

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

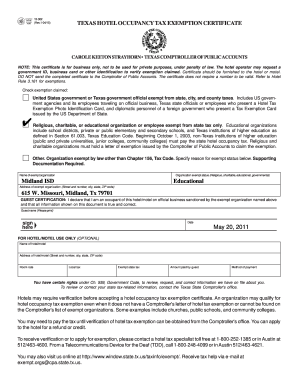

Florida Hotel Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Get And Sign Pdf Affidavit Of No Florida Estate Tax Due Florida Department Of Revenue 2021 2022 Form

Inheritance Tax Waiver Form Tennessee Fill Out And Sign Printable Pdf Template Signnow

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning